ONGC Videsh Ltd. является дочкой и зарубежным подразделением Oil and Natural Gas Corporation Limited (ONGC), флагманской национальной нефтяной компании (NOC) Индии.

Основной деятельностью ONGC Videsh является поиск месторождений нефти и газа за пределами Индии, включая разведку, разработку и добычу нефти и газа. На долю ONGC Videsh приходится 14,8 % добычи нефти и 12,5 % добычи нефти и природного газа в Индии соответственно. По запасам и добыче ONGC Videsh является второй по величине нефтяной компанией Индии, уступая только своей материнской ONGC.

ONGC Videsh имеет долю в 37 нефтегазовых проектах в 17 странах, а именно: Вьетнам (2 проекта), Россия (3 проекта), Судан (2 проекта), Южный Судан (2 проекта), Иран (1 проект), Ирак (1 проект), Ливия (1 проект), Мьянма (4 проекта), Сирия (2 проекта), Бразилия (2 проекта), Колумбия (8 проектов), Венесуэла (2 проекта), Казахстан (1 проект), Азербайджан (2 проекта), Мозамбик (1 проект), Бангладеш (2 проекта) и Новая Зеландия (1 проект).

Компания рискнула выйти на средний уровень и успешно завершила проект продуктопровода протяженностью 741 км в Судане в 2005 году. Запасы ONGC Videsh на 3 п.п. по состоянию на 01.04.2015 составляют 647,485 млн т н.э.

ONGC Videsh Ltd. is the wholly owned subsidiary and overseas arm of Oil and Natural Gas Corporation Limited (ONGC), the flagship national oil company (NOC) of India.

The primary business of ONGC Videsh is to prospect for oil and gas acreages outside India, including exploration, development and production of oil and gas. ONGC Videsh ocontributes to 14.8% of oil and 12.5 % of oil and natural gas production of India respectively.

In terms of reserves and production, ONGC Videsh is the second largest petroleum Company of India, next only to its parent ONGC.

ONGC Videsh has stake in 37 oil and gas projects in 17 Countries, Viz. Vietnam (2 projects), Russia (3 projects), Sudan (2 projects), South Sudan (2 projects), Iran (1 project), Iraq (1 project), Libya (1 project), Myanmar (4 projects), Syria (2 projects), Brazil (2 projects), Colombia (8 projects), Venezuela (2 projects), Kazakhstan (1 project), Azerbaijan (2 projects), Mozambique (1 Project), Bangladesh (2 Projects) and New Zealand (1 Project). ONGC Videsh had ventured into midstream and had successfully completed 741 Km product pipeline project in Sudan in 2005.

ONGC Videsh has 3P reserves of 647.485 MMTOE as on 01.04.2015.

Индийская ONGC заявила о желании расширить участие в «Сахалине-1» после ухода ExxonMobil

Фото: Sergei Karpukhin / Reuters

Индийская государственная компания ONGC Videsh Ltd (OVL) решила расширить свое участие в «Сахалине-1», заняв место ExxonMobil (США), пишет местное издание Times of India со ссылкой на источники. Американский нефтегазовый гигант объявил о выходе из российского проекта в марте.

«OVL готова увеличить штат своего персонала в проекте «Сахалин-1», чтобы после ухода ExxonMobil расширить собственное участие в его реализации совместно с компанией «Роснефть»», — заявил источник. Было также отмечено, что «Роснефть» рассмотрела предложение ONGC и сейчас внимательно изучает список сотрудников.

Проект «Сахалин-1» реализуется на условиях соглашения о разделе продукции. OVL и «Роснефть» владеют долями по 20 процентов, у ExxonMobil и японского консорциума SODECO было по 30 процентов. Один из собеседников Times of India отметил, что индийская компания никогда не заявляла о желании выйти из проекта и имеет длительные деловые отношения с «Роснефтью».

Изначально OVL профинансировала долю «Роснефти» в проекте, поэтому, вероятно, интересы индийской стороны будут защищены в случае национализации компании, считает источник. В начале июля президент России Владимир Путин подписал указ, согласно которому имущество компании-оператора другого проекта в регионе — «Сахалина-2» — будет передано государству.

Весной Reuters со ссылкой на источники писало, что ExxonMobil собиралась полностью уйти из России 24 июня. В апреле дочерняя Exxon Neftegas Ltd. объявила режим форс-мажора и сократила добычу. Вице-премьер Юрий Трутнев заявил, что после решения американской компании добыча нефти на «Сахалине-1» упала в 22 раза, до 10 тысяч баррелей в сутки.

|

|

| Type | Central Public Sector Undertaking |

|---|---|

|

Traded as |

|

| ISIN | INE213A01029 |

| Industry | Energy: Oil and gas |

| Founded | 14 August 1956; 66 years ago |

| Headquarters | Dehradun, Uttarakhand,

India |

|

Area served |

Worldwide |

|

Key people |

Rajesh Kumar Srivastava (Chairman)[1] |

| Products |

|

| Revenue | |

|

Operating income |

|

|

Net income |

|

| Total assets | |

| Total equity | |

| Owner | Ministry of Petroleum and Natural Gas, Government of India[3] |

|

Number of employees |

27,165 (as of March 2022)[4] |

| Divisions |

|

| Subsidiaries |

|

| Website | www.ongcindia.com |

The Oil and Natural Gas Corporation (ONGC) is an Indian central public sector undertaking under the ownership of Ministry of Petroleum and Natural Gas, Government of India. It is headquartered in Dehradun. ONGC was founded on 14 August 1956 by the Government of India. It is the largest government-owned-oil and gas explorer and producer in the country, and produces around 70% of India’s crude oil (equivalent to around 57% of the country’s total demand) and around 84% of its natural gas. In November 2010, the Government of India conferred the Maharatna status to ONGC.

In a survey by the Government of India for fiscal year 2019–20, it was ranked as the largest profit making Central Public Sector Undertaking (PSU) in India. It is ranked 25th among the Top 250 Global Energy Companies by Platts.

ONGC is involved in exploring for and exploiting hydrocarbons in 26 sedimentary basins of India, and owns and operates over 11,000 kilometers of pipelines in the country. Its international subsidiary ONGC Videsh currently has projects in 15 countries. ONGC has discovered 7 out of the 8 producing Indian Basins, adding over 7.15 billion tonnes of In-place Oil & Gas volume of hydrocarbons in Indian basins. Against a global decline of production from matured fields, ONGC has maintained production from its brownfields like Mumbai High, with the help of aggressive investments in various IOR (Improved Oil Recovery) and EOR (Enhanced Oil Recovery) schemes. ONGC has many matured fields with a current recovery factor of 25–33%.[5] Its Reserve Replacement Ratio for between 2005 and 2013, has been more than one.[5] During FY 2012–13, ONGC had to share the highest ever under-recovery of ₹ 89765.78 billion (an increase of ₹ 17889.89 million over the previous financial year) towards the under-recoveries of Oil Marketing Companies (IOC, BPCL and HPCL).[5] On 1 November 2017, the Union Cabinet approved ONGC for acquiring majority 51.11% stake in Hindustan Petroleum Corporation Limited (HPCL). On Jan 30th 2018, Oil & Natural Gas Corporation acquired the entire 51.11% stake of HPCL.

History[edit]

Foundation to 1956[edit]

Pumpjack working in an oilfield of ONGC at Sivasagar, Assam

Before the independence of India in 1947, the Assam Oil Company in the north-eastern and Attock Oil Company in the north-western part of the undivided India were the only oil-producing companies, with minimal exploration input. The major part of Indian sedimentary basins was deemed to be unfit for the development of oil and gas resources.[6]

After independence, the Central Government of India realized the importance of oil and gas for rapid industrial development and its strategic role in defence. Consequently, while framing the Industrial Policy Statement of 1948, the development of the petroleum industry in the country was considered to be of utmost necessity.[6]

Until 1955, private oil companies mainly carried out exploration of hydrocarbon resources of India. In Assam, the Assam Oil Company was producing oil at Digboi (discovered in 1889) and Oil India Ltd. (a 50% joint venture between Government of India and Burmah Oil Company) was engaged in developing two newly discovered large fields Naharkatiya and Moraan in Assam. In West Bengal, the Indo-Stanvac Petroleum project (a joint venture between the Government of India and Standard Vacuum Oil Company of USA) was engaged in exploration work. The vast sedimentary tract in other parts of India and adjoining offshore remained largely unexplored.[6]

In 1955, the Government of India decided to develop the oil and natural gas resources in the various regions of the country as part of the Public Sector development. With this objective, an Oil and Natural Gas Directorate was set up towards the end of 1955, as a subordinate office under the then Ministry of Natural Resources and Scientific Research. The department was constituted with a nucleus of geoscientists from the Geological Survey of India.[6]

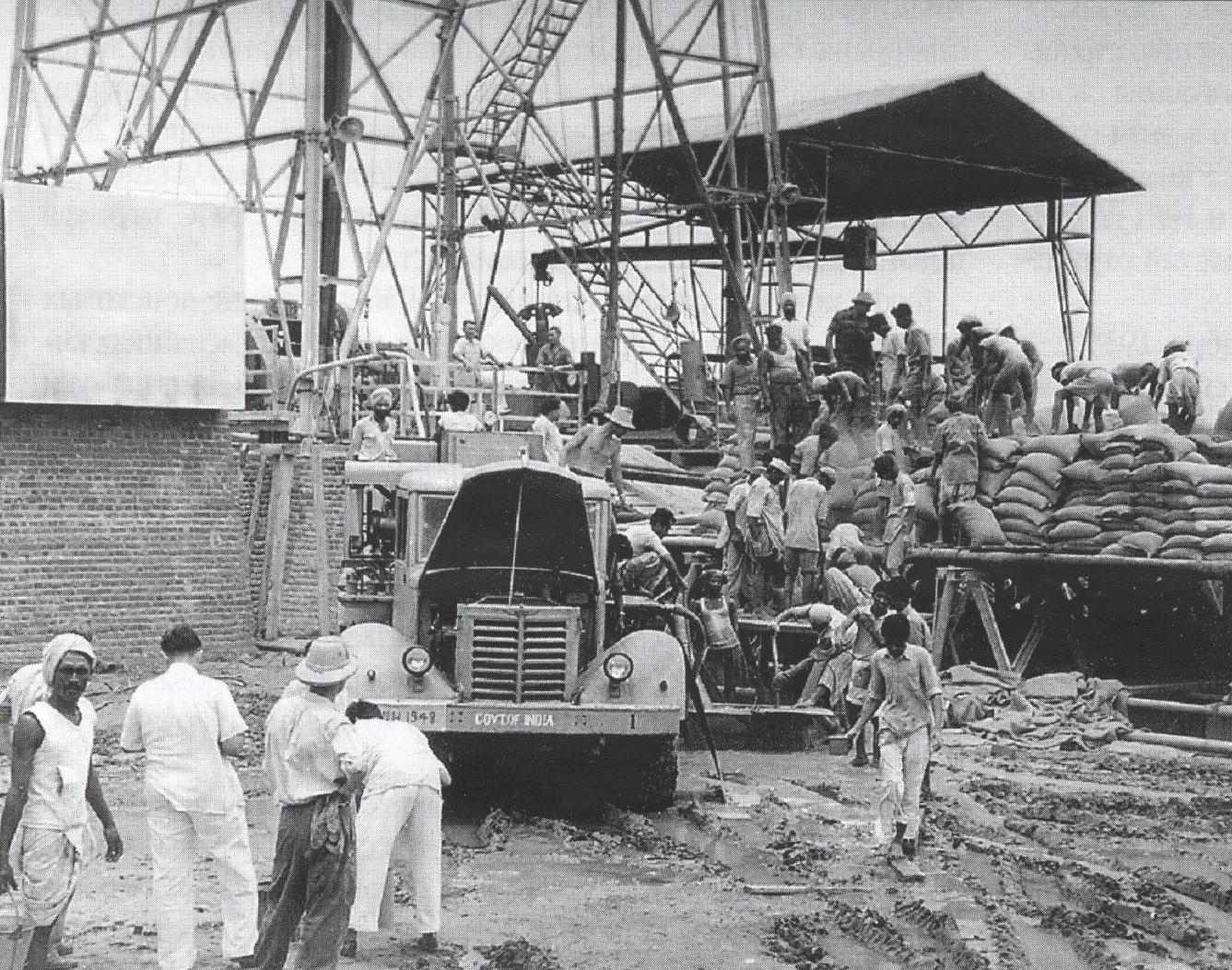

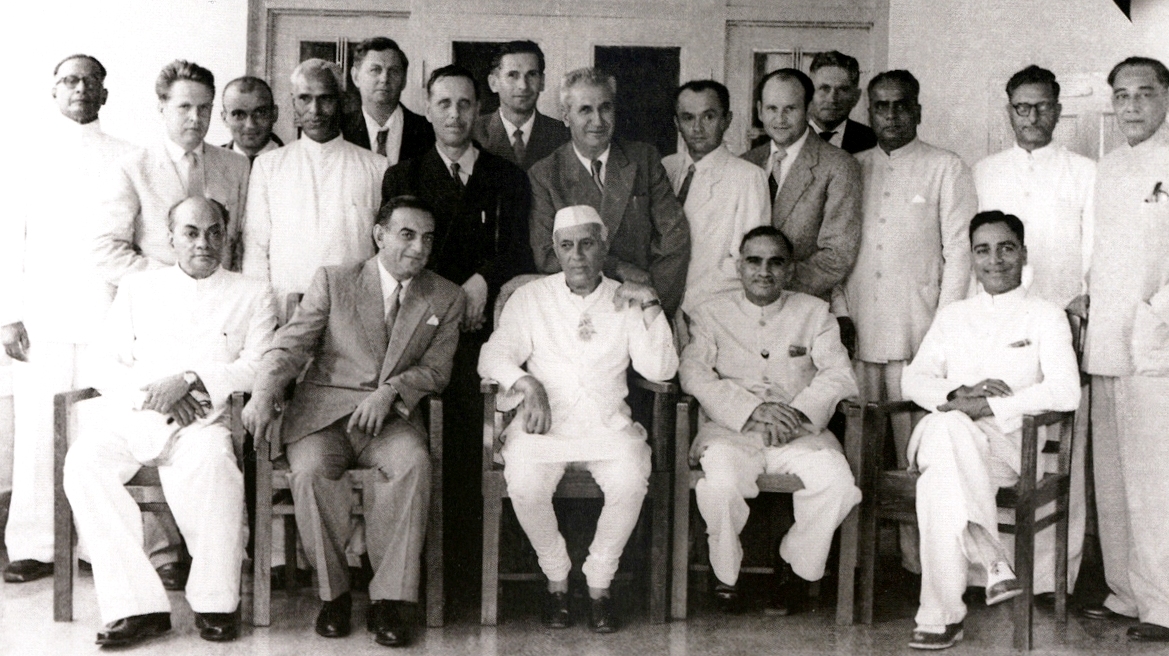

A delegation under the leadership of the Minister of Natural Resources visited several European countries to study the status of the oil industry in those countries and to facilitate the training of Indian professionals for exploring potential oil and gas reserves. Experts from Romania, the Soviet Union, the United States and West Germany subsequently visited India and helped the government with their expertise. Soviet experts later drew up a detailed plan for geological and geophysical surveys and drilling operations to be carried out in the 2nd Five Year Plan (1956–61).[6]

In April 1956, the Government of India adopted the Industrial Policy Resolution, which placed Mineral Oil Industry among the schedule ‘A’ industries, the future development of which was to be the sole and exclusive responsibility of the state.[6]

Soon, after the formation of the Oil and Natural Gas Directorate, it became apparent that it would not be possible for the Directorate with its limited financial and administrative powers as a subordinate office of the Government, to function efficiently. So in August 1956, the Directorate was raised to the status of a commission with enhanced powers, although it continued to be under the government. In October 1959, the commission was converted into a statutory body by an act of the Indian Parliament, which enhanced powers of the commission further. The main functions of the Oil and Natural Gas Commission subject to the provisions of the Act were «to plan, promote, organize and implement programs for development of Petroleum Resources and the production and sale of petroleum and petroleum products produced by it, and to perform such other functions as the Central Government may, from time to time, assign to it «. The act further outlined the activities and steps to be taken by ONGC in fulfilling its mandate.[6]

1961 to 2000[edit]

Since its inception, ONGC has been instrumental in transforming the country’s limited upstream sector into a large viable playing field, with its activities spread throughout India and significantly in overseas territories. In the inland areas, ONGC not only found new resources in Assam but also established new oil province in Cambay basin (Gujarat), while adding new petroliferous areas in the Assam-Arakan Fold Belt and East coast basins (both onshore and offshore).[6]

In 1963, ONGC discovered oil and gas sites in Sivasagar district and established oilfields in Lakua, Gelekey, and Rudrasagar.[7]

ONGC went offshore in the early 1970s and discovered a giant oil field in the form of Bombay High, now known as Mumbai High. This discovery, along with subsequent discoveries of huge oil and gas fields in Western offshore changed the oil scenario of the country. Subsequently, over 5 billion tonnes of hydrocarbons, which were present in the country, were discovered. The most important contribution of ONGC, however, is its self-reliance and development of core competence in E&P activities at a globally competitive level.[6]

ONGC became a public listed company in February 1994,[7] with 20% of its equity were sold to the public and eighty per cent retained by the Indian government. At the time, ONGC employed 48,000 people and had reserves and surpluses worth ₹104.34 billion, in addition to its intangible assets. The corporation’s net worth of ₹107.77 billion was the largest of any Indian company.[citation needed]

In 1958 the then Chairman, Keshav Dev Malaviya, held a meeting with some geologists in the Mussoorie office of the Geology Directorate where he accepted the need for ONGC to go outside India too in order to enhance Indian owned capacity for oil production. The argument in support for this step, by LP Mathur and BS Negi, was that Indian demand for crude would go up at a faster rate than discoveries by ONGC in India.[citation needed]

Malaviya followed this up by making ONGC apply for exploration licences in the Persian Gulf. Iran gave ONGC four blocks and Malaviya visited Milan and Bartlseville to request ENI and Phillips Petroleum to join as partners in the Iran venture. This resulted in the discovery of the Rostum oilfield in the early ‘sixties, very soon after the discovery of Ankleshwar in Gujarat. This was the very first investment by the Indian public sector in foreign countries and oil from Rostum and Raksh was brought to Cochin where it was refined in a refinery built with technical assistance from Phillips.[citation needed]

2001 to present[edit]

In 2003, ONGC Videsh Limited (OVL), the division of ONGC concerned with its foreign assets, acquired Talisman Energy’s 25% stake in the Greater Nile Oil project.[8]

In 2006, a commemorative coin set was issued to mark the 50th anniversary of the founding of ONGC, making it only the second Indian company (State Bank of India being the first) to have such a coin issued in its honour.[citation needed]

In 2011, ONGC applied to purchase 2000 acres of land at Dahanu to process offshore gas.[9] ONGC Videsh, along with Statoil ASA (Norway) and Repsol SA (Spain), has been engaged in deep-water drilling off the northern coast of Cuba in 2012.[10] On 11 August 2012, ONGC announced that it had made a large oil discovery in the D1 oilfield off the west coast of India, which will help it to raise the output of the field from around 12,500 barrels per day (bpd) to a peak output of 60,000 bpd.[11]

In January 2014, OVL and Oil India completed the acquisition of Videocon Group’s ten percent stake in a Mozambican gas field for a total of $2.47 billion.[12]

In June 2015, Oil and Natural Gas Corporation (ONGC) gave a ₹27bn ($427m) offshore contract for the Bassein development project to Larsen & Toubro (L&T).[13]

In February 2016, the board of ONGC approved an investment of ₹ 5,050 crore in Tripura for drilling of wells and creation of surface facilities to produce 5.1 million standard cubic feet per day gas from the state’s fields.[14]

On 19 July 2017, the Government of India approved the acquisition of Hindustan Petroleum Corporation by ONGC.[15]

Operations[edit]

ONGC’s operations include conventional exploration and production, refining and progressive development of alternate energy sources like coal-bed methane and shale gas.[16] The company’s domestic operations are structured around 11 assets (predominantly oil and gas producing properties), 7 basins (exploratory properties), 2 plants (at Hazira and Uran) and services (for necessary inputs and support such as drilling, geo-physical, logging and well services).[16]

Subsidiaries[edit]

ONGC Videsh Limited (OVL) is the international arm of ONGC. It was rechristened on 15 June 1989. The primary business of ONGC Videsh is to prospect for oil and gas acreages outside India, including exploration, development and production of oil and gas. It currently has 38 projects across 17 countries. Its oil and gas production reached 8.87 MMT of O+oEG in 2010, up from 0.252 MMT of O+OEG in 2002/03. ONGC holds 100% stake in ONGC Videsh Limited.[5]

Hindustan Petroleum Corporation Limited (HPCL) is an Indian state-owned oil and natural gas company with its headquarters at Mumbai, Maharashtra. It has about 25% market-share in India among public-sector companies (PSUs) and a strong marketing infrastructure. Oil and Natural Gas Corporation owns 51.11% shares in HPCL and others are distributed amongst financial institutes, public and other investors.[17][18][19] The company is ranked 367th on the Fortune Global 500 list of the world’s biggest corporations as of 2016.[20] Prior to ONGC acquiring majority stake in HPCL, the former was not in the list of Fortune Global 500 while the latter HPCL was.[citation needed]

Presence of ONGC Videsh Limited (OVL) in Latin America;[citation needed]

- Brazil (Block BC-10, BM-SEAL-4, BM-BAR-1, BM-ES-42, BM-S-73 & S-74)

- Colombia (Block LLA-69, RC-8, RC-9, RC-10, SSJN-7 & CPO-5)

- Cuba (Block N-25, N-26, N-27, N-28, N-29 N-34, N-35 & N-36 Block)

- Venezuela (Block San Cristobal, Block Carabobo-1)

Presence of ONGC Videsh Limited (OVL) in CIS & Far-East;[citation needed]

- Vietnam (Block 06.1, 127, 128)

- Myanmar (Block A-1, A-3, AD-2, AD-3 & AD-9, Pipeline Project- PipeCo-1, PipeCo-2)

- Russia (Block Sakhalin-I, 69, 70–1, 70–2, 70–3, 77, 80, 85–1, 85–2 and 86)(15% shares in csjc vancourneft company of vancour)

- Kazakhstan (Satpayev Exploration Block)

Presence of ONGC Videsh Limited (OVL) in Africa;[citation needed]

- Libya (Block NC-189, 81–1, Contract Area 43)

- Nigeria (Block OPL 279, OPL 285, Block-2)

- Sudan & South Sudan (GNOP/GNPOC/GPOC- 1, 2 & 4, Block 5A, Pipeline- Khartoum-Port Project)

- Mozambique (Rovuma Area 1 Offshore)

Presence of ONGC Videsh Limited (OVL) in Middle East;[citation needed]

- (Al Furat (4 PSA), Block-XXIV)

Mangalore Refinery and Petrochemicals Limited is an oil refinery at Mangalore. MRPL has a design capacity to process 15 million metric tons per annum and has 2 Hydrocrackers producing Premium Diesel (High Cetane). It also has 2 CCRs producing Unleaded Petrol of High Octane.[citation needed]

ONGC Mangalore Petrochemicals Limited (OMPL) is an Indian company promoted by Oil and Natural Gas Corporation (ONGC) and Mangalore Refinery and Petrochemicals Limited (MRPL). Both ONGC and MRPL hold respectively 49% and 51% stake in the company.OMPL is a Subsidiary Company of MRPL and also a PSU behalf of share pattern of OMPL. It was incorporated on 19 December 2006. The OMPL complex spans 442 acres of land in Mangalore Special Economic Zone (SEZ). The project cost was estimated at ₹ 5750 crores. The complex is connected with MRPL Refinery, from where they feed to the complex is supplied. It is 14 km away from the New Mangalore Port and about 15 km from Mangalore International Airport.[citation needed]

ONGC Sports[edit]

ONGC is holding many sport teams, such as athletics, badminton, basketball, boxing, chess, cricket, cue sports, carrom, field hockey, football, kabaddi, shooting, table tennis, tennis, volleyball and wrestling. Its football team, ONGC F.C., once played in Indian I-League.[citation needed]

The basketball team, in particular, is known internationally since several of the players of India’s national basketball team have played there. These players include Vishesh Bhriguvanshi, Amritpal Singh, Yadwinder Singh, and others.[citation needed]

Joint Ventures[edit]

ONGC Tripura Power Company[edit]

ONGC Tripura Power Company (OTPC) is a joint venture which was formed in September 2008 between ONGC, Infrastructure Leasing and Financial Services Limited and the government of Tripura. It has developed a 726.6 MW CCGT thermal power generation project at Palatana in Tripura which supply electricity to the power deficit areas of the northeastern states of the country.[21] OTPC has 2 no 9FA machines supplied by GE USA.[citation needed]

ONGC Petro Additions Limited[edit]

ONGC Petro additions Limited (OPaL), a multi-billion joint venture company was incorporated in 2006, as a Public Limited Company under the Companies Act, 1956, promoted by Oil and Natural Gas Corporation (ONGC) and co-promoted by GAIL and GSPC.[citation needed] ONGC owns 49.36% of shares in OPaL, while GAIL has 49.21% per cent and the remaining 1.43% per cent is held by GSPC.[22]

The project began its operation after the inauguration by Prime Minister Narendra Modi in March 2017.[23][24]

OPaL is setting up a grass root mega Petrochemical project at Dahej, Gujarat in PCPIR/SEZ. The complex’s main Dual Feed Cracker Unit has the capacity to produce 1100 KTPA Ethylene, 400 KTPA Propylene and the Associated Units consists of Pyrolysis Gasoline Hydrogenation Unit, Butadiene Extraction Unit and Benzene Extraction Unit. The Polymer plants of OPaL has 2X360 KTPA of LLDPE/HDPE Swing unit, 1X340 KTPA of Dedicated HDPE and 1×340 KTPA of PP. All the major contracts have been awarded and the construction is in full swing.[citation needed]

Products and services[edit]

ONGC supplies crude oil, natural gas, and value-added products to major Indian oil and gas refining and marketing companies. Its primary products crude oil and natural gas are for the Indian market.[16]

Product-wise revenue breakup for FY 2016–17 (₹ billion):[25]

| Product | Revenue |

|---|---|

| Crude oil | 562.38 |

| Gas | 168.88 |

| LPG | 031.48 |

| Naphtha | 076.80 |

| C2-C3 | 013.44 |

| SKO | 003.69 |

| Others | 001.59 |

| Adjustments | – 32.74 |

| Total | 825.52 |

Listings and Shareholding[edit]

The equity shares of ONGC are listed on the Bombay Stock Exchange,[26] where it is a constituent of the BSE SENSEX index,[27] and the National Stock Exchange of India,[28] where it is a constituent of the S&P CNX Nifty.[29]

As on 31 March 2013, Government of India held around 69% equity shares in ONGC. Over 480,000 individual shareholders hold approx. 1.65% of its shares.[30] Life Insurance Corporation of India is the largest non-promoter shareholder in the company with 7.75% shareholding.[5]

| Shareholders (as on 31-Mar-2013) | Shareholding[5] |

|---|---|

| Promoter – Government of India | 68.94% |

| Government Companies | 10.09% |

| Banks, Financial Inst. & Insurance companies | 09.69% |

| Foreign Institutional Investors (FII) | 06.27% |

| Private Corporate Bodies | 11.83% |

| Individual shareholders | 01.65% |

| Mutual Funds and UTI | 01.13% |

| NRI/Employees | 00.11% |

| Total | 100.0% |

Employees[edit]

As on 31 March 2017, the company has 33,600 employees, out of which 2,208 are women (6.57%) and 245 are employees with disabilities (0.73%).[31]

Awards and recognitions[edit]

- ONGC is the top Employer in the Energy sector in India, in the Randstad Awards 2013.[32]

- ONGC was one of 12 winners of the ‘Golden Peacock Award 2014’ for its corporate social responsibility practices,[33] and one of 24 winners of the ‘Golden Peacock Award 2013’ in the occupational safety and health category.[34]

- In April 2013, it was ranked at 155th place in the Forbes Global 2000 for 2012.[35][36]

- In 2011, ONGC was ranked 39th among the world’s 105 largest listed companies in ‘transparency in corporate reporting’ by Transparency International making it the most transparent company in India.

- It was conferred with ‘Maharatna’ status by the Government of India in November 2010.[37] The Maharatna status to select PSUs allows more freedom in decision making.[37][38]

- In February 2014, FICCI conferred it with Best Company Promoting Sports Award.[39]

- ONGC wins the «Greentech Excellence Award» for the year 2013 in Platinum Category

- ONGC was ranked 82nd among India’s most trusted brands according to the Brand Trust Report 2012, a study conducted by Trust Research Advisory. In the Brand Trust Report 2013, ONGC was ranked 191st among India’s most trusted brands and subsequently, according to the Brand Trust Report 2014, ONGC was ranked 370th among India’s most trusted brands.[40]

- ONGC is the title sponsor for the first edition of the Corporate social responsibility (CSR) Award organised by Amar Ujala[41]

Controversies[edit]

Despite being owned by the government of India, ONGC has repeatedly been found not claiming its rightful payments from private players, especially for the use of oil fields, oil rigs and concessions.[42]

ONGC was owed ₹ 92,000 crores from Reliance Industries Limited (Petrochemicals) for the use of blocks of oil fields. This was highlighted by the Comptroller and Auditor General of India (CAG), the overseer of expenditures of the Indian Government. However, as of 2018, this outstanding amount was still not paid by Reliance Industries Limited to ONGC.[43]

On 21 April 2021, three employees (Mohini Mohan Gogoi, Alakesh Saikia, Retul Saikia) of the ONGC were allegedly abducted from Lakuwa field of Assam’s Sivasagar district.[44] Authorities suspect that the banned United Liberation Front of Asom (Independent) is behind the abduction.[45]

See also[edit]

- List of companies of India

- List of largest companies by revenue

- List of corporations by market capitalization

- Make in India

- Forbes Global 2000

- Fortune India 500

- Indian Institute of Technology (Indian School of Mines), Dhanbad

- Rajiv Gandhi Institute of Petroleum Technology

- University of Petroleum and Energy Studies, Dehradun

References[edit]

- ^ «Oil Ministry mulls proposal for new ONGC chairman, may extend higher age limit». mint. 19 June 2022. Retrieved 5 July 2022.

- ^ a b c d e «ONGC Financial statements». moneycontrol.com.

- ^ Limited, Oil and Natural Gas. «Shareholding pattern» (PDF).

- ^ «ONGC Eng AR 2021–22».

{{cite web}}: CS1 maint: url-status (link) - ^ a b c d e f «Annual Report 2012-13» (PDF). ONGC. 29 May 2013. Archived (PDF) from the original on 9 November 2013. Retrieved 9 November 2013.

- ^ a b c d e f g h i «History». ONGC. Archived from the original on 9 November 2013. Retrieved 10 November 2013.

- ^ a b Barbora, Sanjay; Phukan, Sarat (5 April 2022). «Mines, plantations, and militarisation: Environmental conflicts in Tinsukia, Assam». Environment and Planning E: Nature and Space: 251484862210898. doi:10.1177/25148486221089820. ISSN 2514-8486. S2CID 248016289.

- ^ «Talisman pulls out of Sudan». BBC News. Associated Press. 10 March 2003. Archived from the original on 12 November 2012. Retrieved 4 May 2012.

- ^ Lewis, Clara (11 September 2011). «ONGC seeks 2K acres govt land at Dahanu». The Times of India. Times News Network. Archived from the original on 13 July 2012. Retrieved 13 September 2011.

- ^ Oil and Gas Journal 22May2012 http://www.ogj.com/articles/2012/05/repsol-declares-cuba-deepwater-wildcat-dry.html Archived 20 September 2015 at the Wayback Machine

- ^ «ONGC makes huge oil discovery off West coast». 12 August 2012. Archived from the original on 17 August 2012. Retrieved 12 August 2012.

- ^ OVL and OIL complete acquisition of Mozambique’s offshore gas field, Africa: Oil Review Africa, 2014, archived from the original on 13 January 2014, retrieved 13 January 2014

- ^ L&T secures $427m offshore contract for Bassein gas field project from ONGC, 2015, archived from the original on 26 June 2015, retrieved 27 June 2015

- ^ «ONGC board approves Rs. 5,050-cr investment in Tripura». The Hindu. Agartala. PTI. 20 February 2016. Retrieved 21 February 2016.

- ^ «Cabinet allows ONGC to buy out govt stake in refiner HPCL». 19 July 2017. Retrieved 19 July 2017.

- ^ a b c «Corporate Sustainability Report 2011-12» (PDF). ONGC. Archived (PDF) from the original on 9 November 2013. Retrieved 10 November 2013.

- ^ «Sustainability report 2013-14» (PDF). 2014. p. 7. Archived (PDF) from the original on 17 March 2015. Retrieved 13 May 2015.

- ^ «List of Maharatna, Navratna and Miniratna CPSEs |». Archived from the original on 19 July 2013. Retrieved 28 July 2013. Navratna

- ^ «ONGC buys govt’s entire 51.11% stake in HPCL for Rs 36,915 crore». The Economic Times. 31 January 2018. Archived from the original on 17 April 2018. Retrieved 28 April 2018.

- ^ «Fortune Global 500 list». CNN Money. Archived from the original on 21 August 2016. Retrieved 22 July 2016.

- ^ «We are the largest Natural Oil and Gas Company to Work in India». www.ongcindia.com. Retrieved 25 February 2022.

- ^ Verma, Nidhi (12 September 2019). «ONGC looks at buying out partners in OPaL». Deccan Chronicle. Retrieved 5 November 2022.

- ^ Pathak, Kalpana (28 March 2017). «ONGC to raise Rs1,671 crore for associate firm OPaL». mint. Retrieved 1 November 2022.

- ^ «Modi to inaugurate Rs 30,000 crore OPaL petrochemical project in March — ET EnergyWorld». ETEnergyworld.com. Retrieved 5 November 2022.

- ^ «Financial Results: 2013–14 Q1- ONGC/OVL/MRPL» (PDF). ONGC. August 2013. Archived (PDF) from the original on 10 November 2013. Retrieved 10 November 2013.

- ^ «ONGC LTD». BSEindia.com. Archived from the original on 9 November 2013. Retrieved 9 November 2013.

- ^ «Scripwise Weightages in S&P BSE SENSEX». BSE India. Archived from the original on 1 December 2015. Retrieved 9 November 2013.

- ^ «NTPC Limited». NSE India. Archived from the original on 9 November 2013. Retrieved 9 November 2013.

- ^ «Download List of CNX Nifty stocks (.csv)». NSE India. Archived from the original on 13 October 2013. Retrieved 9 November 2013.

- ^ «Shareholding Pattern as on 31 March 2013». MoneyControl.com. Archived from the original on 9 November 2013. Retrieved 9 November 2013.

- ^ «ONGC Annual report 2016-17» (PDF). Archived (PDF) from the original on 1 September 2017. Retrieved 1 September 2017.

- ^ «Microsoft most attractive employer in India: Survey». The Times of India. 19 April 2013. Archived from the original on 9 November 2013. Retrieved 10 November 2013.

- ^ «Corporate Social Responsibility (GPACSR)». goldenpeacockawards.com. Archived from the original on 9 November 2013. Retrieved 26 June 2015.

- ^ «Occupational Health & Safety Award (GPOHSA)». goldenpeacockawards.com. Archived from the original on 27 June 2015. Retrieved 26 June 2015.

- ^ «Forbes Global 2000: ONGC climbs 16 ranks to position at 155». ONGC. 18 April 2013. Archived from the original on 9 November 2013. Retrieved 10 November 2013.

- ^ «Oil & Natural Gas». Forbes. 17 April 2013. Archived from the original on 4 November 2013. Retrieved 10 November 2013.

- ^ a b «ONGC, IOC conferred Maharatna status». Business Standard. 16 November 2010. Archived from the original on 9 November 2013. Retrieved 10 November 2013.

- ^ «Maharatna status for IOC, ONGC and NTPC». The Hindu. 16 November 2010. Archived from the original on 10 November 2013. Retrieved 10 November 2013.

- ^ «FICCI announces the Winners of India Sports Awards for 2014». IANS. news.biharprabha.com. Archived from the original on 4 August 2017. Retrieved 14 February 2014.

- ^ «India’s Most Trusted Brands 2014». Archived from the original on 2 May 2015.

- ^ «Amar Ujala CSR Award». Amar Ujala. Archived from the original on 30 October 2017. Retrieved 31 October 2017.

- ^ «CAG hauls up ONGC for giving oil rigs to RIL for free». Times of India. 4 November 2012. Archived from the original on 7 September 2012. Retrieved 31 October 2018.

- ^ «Auditors report» (PDF). www.tenders.ongc.co.in. ONGC. Retrieved 31 October 2018.

- ^ «Three ONGC employees ‘abducted’ in Assam, ULFA-I suspected». The Indian Express. 21 April 2021. Retrieved 21 April 2021.

- ^ «Ulfa abducts 3 ONGC personnel from Assam’s Charaideo district — Times of India». The Times of India. Retrieved 21 April 2021.

Further reading[edit]

- Matthew Shutzer. 2022. «Oil, Money and Decolonization in South Asia.» Past & Present.

- «UPSTREAM INDIA Fifty Golden Years of ONGC» by ONGC group publications year 2006 is official narrative of the history of ONGC.

- Story of ONGC by I.A.Farooqi gives a historical account of Oil and Natural Gas Corporation from its foundation to the year 2000.

External links[edit]

- Official website

Адрес:

26, Kasturba Gandhi Marg, New Delhi 110001, India

Телефон:

+00-91-11-23730368, 41291100

Факс:

+00-91-11-23730369, 23721755

E-mail:

contact@ongcvidesh.in

ONGC Videsh Limited (OVL) was rechristened on 15th June 1989 from the earstwhile Hydrocarbons India Private Limited, which was incorporated on 5th March, 1965. Over a period of time, OVL has grown to become the second-largest E&P company in India both in terms of oil production and oil and gas reserve holdings. The primary business of OVL is to prospect for oil and gas acreages abroad including acquisition of oil and gas fields, exploration, development, production, transportation and export of oil and gas. OVL is a wholly-owned subsidiary of Oil and Natural Gas Corporation Limited (ONGC) — the flagship national oil company of India.

Starting with the exploration and development of the Rostam and Raksh oil fields in Iran and undertaking a service contract in Iraq, a major breakthrough was achieved by OVL in 1992 in Vietnam with the discovery of two major free gas fields, namely LanTay and LanDo, in partnership with British Petroleum and Petro-Vietnam. The success carried on thereafter. In 2001, OVL acquired 20% stake in Sakhalin-1 project in the far east of Russia. In January 2009, OVL completed the acquisition of Imperial Energy Corporation Plc.- an UK listed company, having its exploration and production assets in Tomsk region of Western Siberia, Russia with an investment of over USD 2.1 billion.

The company, adopting a balanced portfolio approach, maintains a combination of producing, discovered and exploration assets, working as operator in 11 projects and joint operator in 6 projects. OVL produces hydrocarbons from its 9 assets, namely, Russia (Sakhalin-I and Imperial), Syria (Al-Furat Project), Vietnam (Block 06.1), Colombia (Mansarover Energy Project), Sudan (Greater Nile Oil Project and Block 5A), Venezuela (San Cristobal Project) and Brazil (BC-10) ; 6 projects are in development phase and 23 are in the exploration phase. OVL has successfully completed 741 km long pipe line project in Sudan.

Полный материал…

OVL’s international oil and gas operations produced 8.87 MMT of O+OEG in 2009-10 as against 0.252 MMT of O+OEG in 2002-03. OVL’s overseas cumulative investment has crossed USD 10 billion.

While OVL participates and operates in varied environments – both political and geographical, it is committed to the highest standards of Occupational Health, Safety and Environment protection and compliance to all applicable local laws and regulations. Understanding well its Corporate Social Responsibility, OVL makes valuable contributions to the communities and economies in which it operates by investing in education and training, improving employment opportunities for nationals, and providing medical, sports and/or agricultural facilities, besides payment of tax revenues to local governments.

Some of the leading alliance partners of OVL are BP, CNPC, Ecopetrol, ENI, Exxon, Statoil Hydro, PDVSA, Petrobras, Petronas , Petrovietnam, Repsol, Rosneft, Shell, Sinopec, Total and TPOC.

Последнее обновление: 6 мая 2015

- Все материалы (2)

- Новости (2)

В 1867 году на севере индийского штата Ассам небольшая изыскательская группа под руководством железнодорожного инженера обнаружила, что ноги слона — основной тягловой силы изыскателей — покрыты странной черной грязью со специфическим запахом нефти. Это событие положило начало геологоразведочным работам в Индии. Вскоре на этом месте вырос городок Дигбой, получивший свое название от фразы «Dig, boy» («копай, мальчик») — именно так английские колонизаторы мотивировали местное население на поиски «черного золота».

Работы увенчались успехом в 1889 году, когда на небольшой глубине (около 50 метров) была найдена нефть в промышленных объемах. В том же году для управления нефтедобычей в регионе была создана Assam Oil Company, вскоре построившая в Дигбое нефтеперерабатывающий завод. Месторождение достигло пика добычи в годы Второй Мировой войны, когда добывалось около 7 тыс. баррелей нефти в день, затем наступил резкий спад. Тем не менее, местный нефтеперерабатывающий завод получил всемирную известность как старейший в мире НПЗ, работающий до настоящего времени.

На заре независимости

Несмотря на давнюю историю нефтедобычи, к середине 20 века, на фоне нефтяного бума на Ближнем и Среднем Востоке, считалось, что Южная Азия (Индия) не богата нефтью. Запасы углеводородов, открытые в Ассаме, были незначительными. Добыча нефти в стране составила около 200 тыс. тонн в год. При этом нефтяная отрасль Индии была, по сути, монополизирована — три компании, Burmah (подразделение Shell), Stanvac и Caltex в совокупности контролировали более 95% индийского рынка. Естественно, это обстоятельство вызывало острую критику в политических и деловых кругах молодой республики, провозгласившей независимость в 1947 году.

«Фонтан процветания»

ONGC — возможно, первая нефтяная компания в мире, которая начала свою работу, не имея «за душой» ни одного барреля нефти и ни одного кубометра попутного газа. Поэтому самой первой и самой важной задачей, которую стали решать руководители ONGC, была интенсификация геологоразведки и обеспечение резкого прироста запасов. На помощь пришли советские геологи. В Индию прибыла большая группа специалистов во главе с известным геологом, лауреатом Ленинской премии Николаем Калининым. Были подобраны и местные кадры в лице 150 первоклассных геологов, выпускников лучших вузов страны.

Уже в сентябре 1958 года в ходе бурения с использованием российской буровой установки на структуре Лунедж в бассейне Камбэй (штат Гуджарат) было открыто крупное нефтяное месторождение. Через полтора года еще более внушительное открытие было сделано вблизи городка Анклешвар, также в штате Гуджарат. Джавахарлал Неру, посетивший промысел, назвал его Васудара — «фонтан процветания». И сегодня, после почти 60 лет интенсивной эксплуатации на Васударе по-прежнему добывается высококачественная легкая нефть в стабильных объемах и при низкой себестоимости. Основные объемы этой нефти перерабатываются на специально построенном НПЗ в Койали (кстати, именно с этого завода началась история крупнейшей индийской даунстрим-компании Indian Oil).

Крупные открытия в Западной Индии продолжались — в течение последующих трех лет были открыты месторождения Калол, Сунанд и Навагам. Затем последовали открытия на востоке страны, в частности, в Рудрасагаре (штат Ассам).

На суше и на море

В 1959 году полномочия ONGC были расширены путем преобразования комиссии в государственную организацию, учрежденную на основании постановления индийского парламента. Основными задачами ONGC, согласно этому акту, стали планирование, поддержка, организация и реализация программ разработки нефтяных ресурсов и производства и продажи нефти и нефтепродуктов.

Середина шестидесятых годов была временем испытаний для ONGC: Малавия ушел со своего поста в результате коррупционного скандала, Гош умер, скончался и Неру, главный покровитель ONGC. Тем не менее, ONGC шла вперед, перенеся акцент в геологоразведке на шельф Аравийском море, где в сотрудничестве с советскими геологами, исследовавшими недра с научного судна «Академик Архангельский», в течение десяти лет были открыты пять глубоководных месторождений — Бомбей-Хай, Бассейн, Панна, Хира и Тапти. Следующее десятилетие охарактеризовалось нефтяными и газовыми открытиями в Западном Годавари, Южном Тамилнаде (бассейн Ковери), Нагаленде, Барамуре и Трипуре.

Помимо лидерства в нефтедобыче, Бомбей-Хай стал и пионером в деле утилизации попутного газа. В начале 80-х годов от Бомбей-Хай до побережья был протянут газопровод, давший новый импульс энергетическому комплексу страны и предприятиям по производству минеральных удобрений. Вскоре аналогичный масштабный проект был осуществлен в штате Гуджарат.

Крупнейшая коммерческая организация

В 1993 году ONGC была реорганизована в акционерное общество с ограниченной ответственностью — Oil and Natural Gas Corporation Ltd. (соответственно, аббревиатура осталась прежней), 2% акций были приватизированы, еще 2% — распространены среди работников. Компания выплачивает своим акционерам (прежде всего, государству — 74,14% акций принадлежат правительству страны) до миллиарда долларов ежегодно; это наиболее высокие дивиденды в индийской истории.

В 2003 года ONGC получила контроль над Mangalore Refinery & Petrochemicals, прежде принадлежавшей Birla Group, существенно увеличила объемы нефтепереработки и объявила о своем вхождении в розничный бизнес. В 2017 году компания поглотила Hindustan Petroleum Corporation, упрочив свое безусловное лидерство на индийском нефтяном рынке.

При этом компания открыта к сотрудничеству (в том числе, и с иностранными инвесторами) и весьма эффективно управляет своим портфелем активов. В частности, 3 года назад ONGC за 0,43 млрд долларов продала датской компании Larsen & Toubro право на разработку оффшорного месторождения Бассейн.

В духе современных тенденций глобализации и интернационализации ONGC, не отрываясь от национальной базы, через свою дочернюю компанию ONGC Videsh реализует 41 проект в 20 странах мира, включая Россию (проект «Сахалин-1»).

Григорий Волчек